Power smarter lending with geospatial data for a competitive edge.

PolicyMap empowers commercial banks, CDFIs, and credit unions with critical data and insights to support lending decisions and strategic investments. By providing access to neighborhood-level data from over 170 trusted public and proprietary sources, PolicyMap enables financial institutions to identify opportunities, assess risk, and meet community development goals.

From evaluating market potential to guiding CRA compliance and targeting underserved areas, PolicyMap equips lenders with the tools they need to drive meaningful impact. Make data-driven decisions that foster economic growth, strengthen communities, and align with your mission to deliver value where it’s needed most.

Zoom in to explore LMI areas designated by the CDFI Fund, or click to open in PolicyMap.

EXCLUSIVE NEW DATA

Housing Gap Estimates from Moody’s Analytics!

New research from Moody’s Analytics, PolicyMap, and Reinvestment Fund offers the most detailed, census tract-level analysis to date of the U.S. housing shortage, revealing a critical gap in rental housing, especially in moderate and middle-income areas.

Explore housing shortage data across nearly 350 American cities with populations over 100,000 on PolicyMap now: total housing unit gap, total owner housing unit gap, and total rental housing unit gap.

Dive into census tract-level insights to see exactly where rental and owner gaps exist and how severe the need is estimated to be. Use these maps to inform planning, investment, and policy decisions in the communities you serve.

REQUEST A DEMO

See PolicyMap In Action

Learn how you can use data to build equitable foundations for your community with clear, data-driven insights highlighting the issues that matter most.

Who We Help

Commerical Banks

Make data-driven decisions for lending, investment, and risk management. Download more information here.

Credit Unions & Community Development Financial Institutions (CDFIs)

Target underserved areas and support community-focused lending strategies. Download more information here.

Tax Incentive Professionals

CDFI, CDE, NMTC consultants can identify neighborhoods with high demand and assess potential investment opportunities. Download more information here.

Did you know?

PolicyMap was founded as a small division of Reinvestment Fund, a Philadelphia-based Community Development Financial Institution (CDFI), in 2007. Initially designed by and for CDFIs, PolicyMap transitioned to a for-profit small business and benefit corporation in 2018, continuing its mission of using data to drive impact.

How We Help

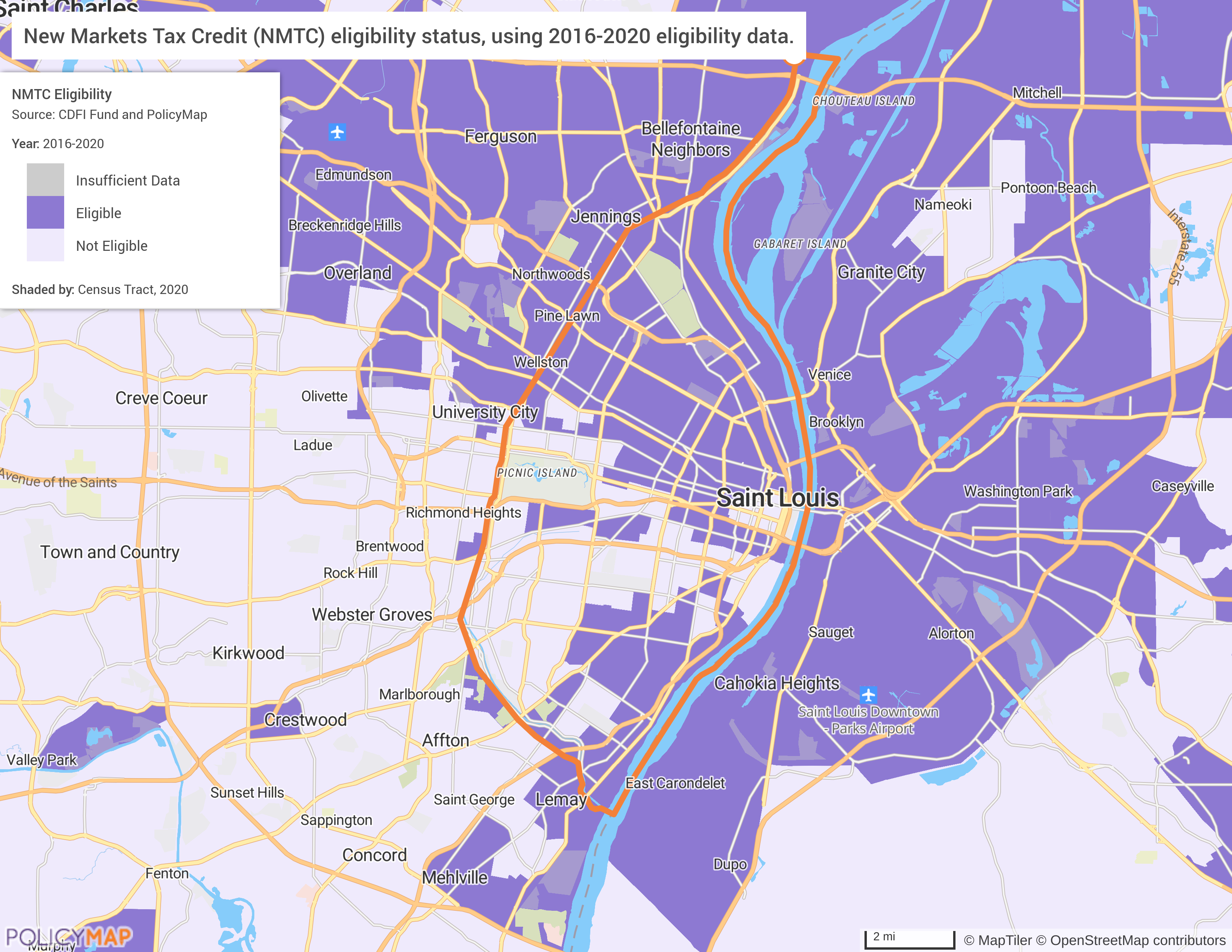

Locate Key Census Tracts for Development Projects

- CRA-Eligible Areas: Locate areas that qualify for Community Reinvestment Act (CRA) credit, encouraging investment in underserved neighborhoods. Read more.

- New Markets Tax Credits: Identify NMTC-eligible census to attract private investment for projects in low-income communities. Read more.

- LIHTC: Explore census tracts that meet the criteria for Low-Income Housing Tax Credit (LIHTC) projects, providing incentives to developers for creating affordable housing. Read more.

- CDFI certification: Discover areas served by Community Development Financial Institutions (CDFIs) or where certification requirements can be met to support economic growth in distressed areas.

- Opportunity Zones: Identify census tracts designated as Opportunity Zones to direct investments that qualify for federal tax incentives.

Understanding Community Needs and Resources

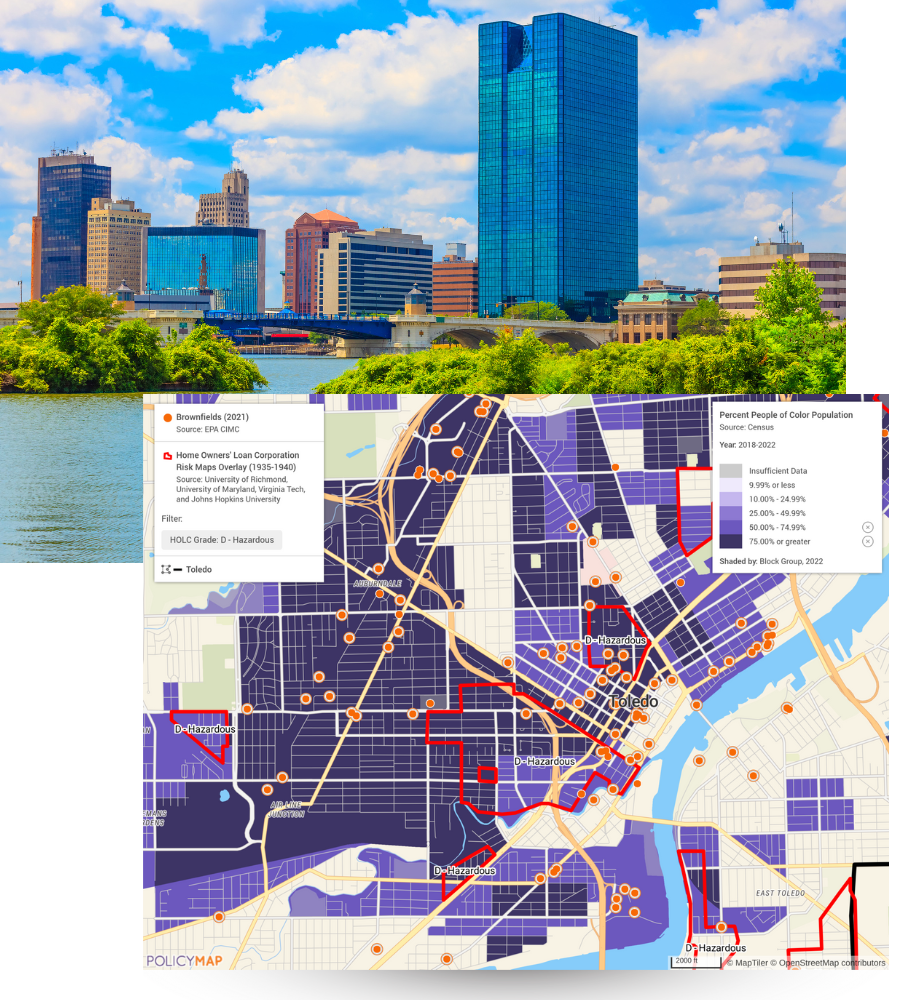

- Environmental Factors: Incorporate data on environmental burdens, such as urban heat islands or flood-prone areas, to guide resilient and sustainable developments. Read more.

- Demographic Analysis: Study population trends, income levels, and age distributions to prioritize projects that meet community needs. Read more.

- Health and SDOH Data: Use insights on social determinants of health to address housing and economic disparities with targeted investments. Read more.

Let’s Talk.

PolicyMap can help you prioritize investments, build resilient communities, and ensure equitable growth.

Ready to learn more? Fill in the form to request more information about our data sources.

Our Solutions

All the data you need. All in one place.

Online Platform

cloud-based; annual subscription for individual, team, or enterprise

Bulk Data

via flat file, API, or Snowflake

Embed & Share

add our maps and data to your website

Partner Portal

provide access for your partners or members

Dashboards & Reports

communicate actionable data insights

Insights & Client Solutions

consulting and custom development