How Cutting CDFI Funding Hurts Homebuyers

Community Development Financial Institutions (CDFIs) play a crucial role in providing financial services to low-income communities—areas often overlooked by traditional banks. These mission-driven lenders offer affordable loans to small businesses, schools, grocery stores, daycare centers, and homebuyers who would otherwise struggle to access capital, helping to spur economic growth and stability across the country. Shrinking or defunding CDFIs threatens to dismantle this vital system, cutting off financial access for those who need it most. Without CDFI funding, many will face an even steeper uphill battle to build businesses, secure housing, and create jobs, deepening economic disparities in states already facing significant financial challenges. In this article, we explore, as an example, how CDFIs benefit homebuyers across the state of Mississippi.

Before we get started, it is important to provide background on CDFIs. At PolicyMap, we collaborate with numerous Community Development Financial Institutions (CDFIs) to ensure they have the data needed to make strategic investment decisions. Interestingly, we also spun out of a CDFI ourselves—Reinvestment Fund—before forming PolicyMap, Inc. as a separate, for-profit benefit corporation in 2016. Given this background, the ongoing discussions about potentially reducing the role of CDFIs are especially meaningful to us.

The Mission of CDFIs

CDFIs exist to serve communities where investment and lending are most needed. They provide financial resources that support day care centers, school facilities, grocery stores, small businesses, consumer banking, housing, and more—all essential assets for building strong, vibrant communities.

What Are CDFIs?

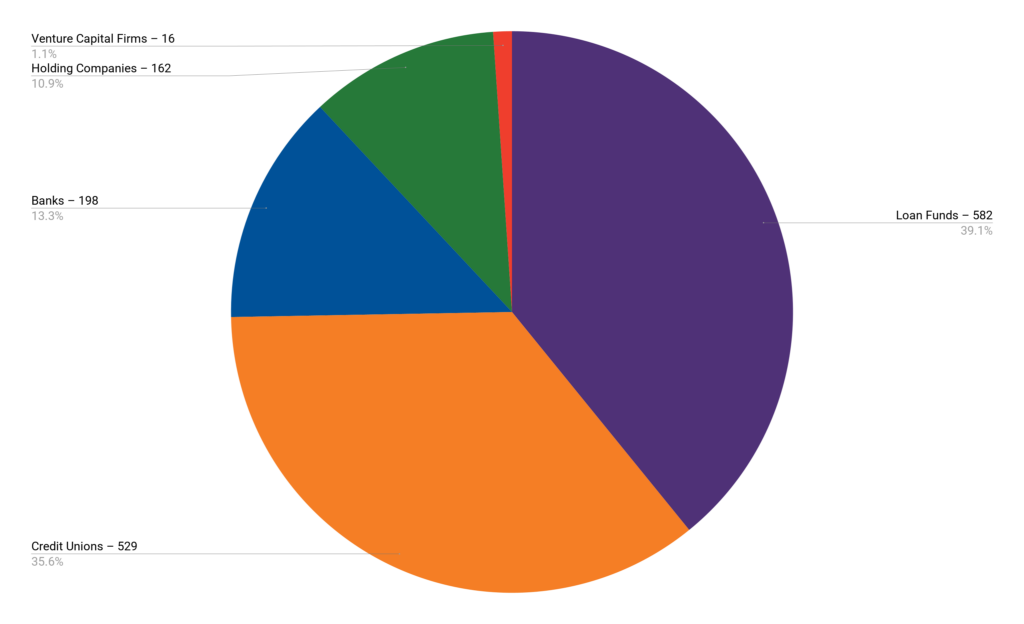

CDFIs are specialized financial institutions that provide affordable lending and financial services to individuals, small businesses, and nonprofits, with a focus on communities underserved by traditional banks. Currently, 1,462 CDFIs operate in the U.S.

Types of CDFIs

- Community Development Banks – Privately owned banks focused on economic development in low-income communities.

- Community Development Credit Unions – Member-owned, nonprofit institutions providing financial services to underserved populations.

- Community Development Loan Funds – Nonprofit funds offering affordable loans to small businesses, nonprofits, and individuals.

- Community Development Venture Capital Funds – Investment funds that provide capital to businesses in economically distressed areas.

CDFIs Enable More People to Buy Homes

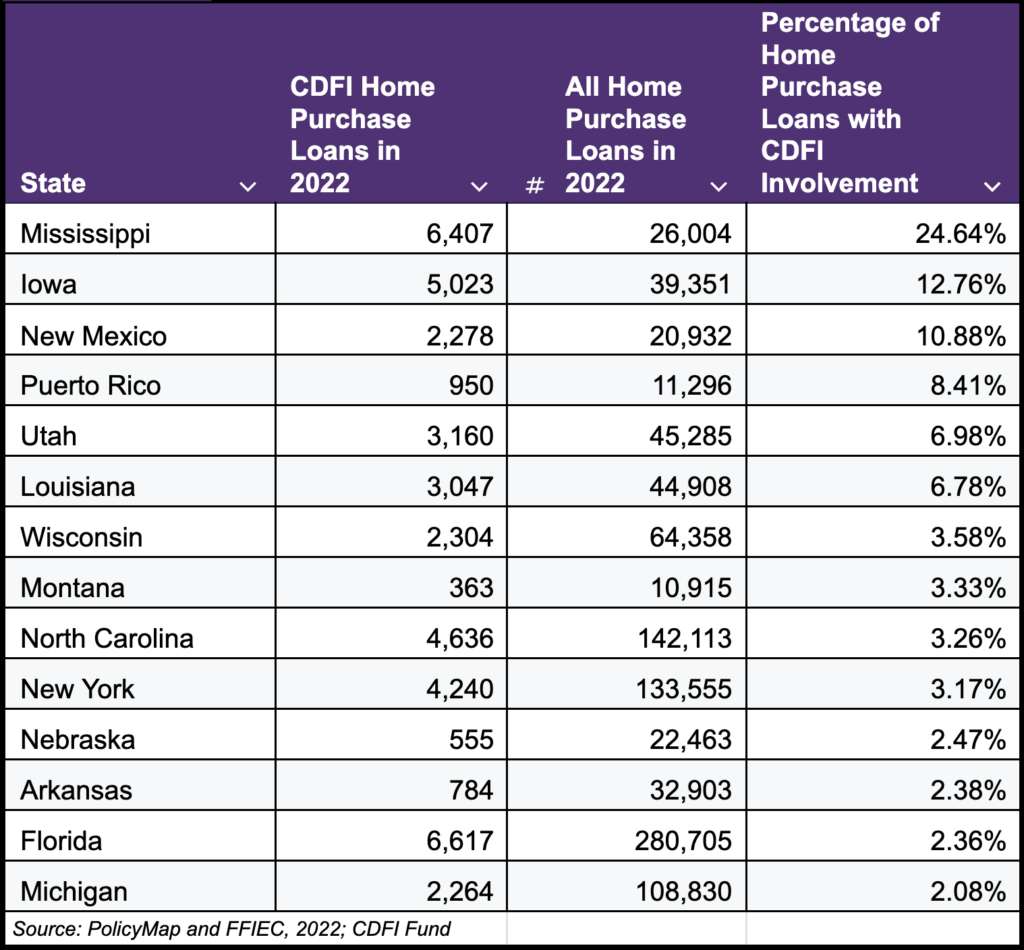

In 2022, CDFIs played an active role in home lending across all 50 states. Of the 3.6 million home purchase loans made by reporting institutions in states across the US that year, CDFIs participated in 66,250—representing 1.82% of the total.

CDFI home loan participation was significantly higher in states such as Mississippi, Iowa, New Mexico, Puerto Rico, Utah, and Louisiana, and moderately higher in states like Wisconsin, Montana, North Carolina, New York, Nebraska, Arkansas, Florida, and Michigan. In many of these states, the strong presence of CDFI credit unions and banks likely drove this increased involvement.

CDFIs are critical for expanding homeownership among low- and moderate-income (LMI) individuals. They offer:

- Lower-interest home loans with flexible underwriting criteria.

- Down payment assistance or loans with lower down payment requirements.

- Financial education and counseling to prepare homebuyers for sustainable homeownership.

Digging Deeper: The Case of Mississippi

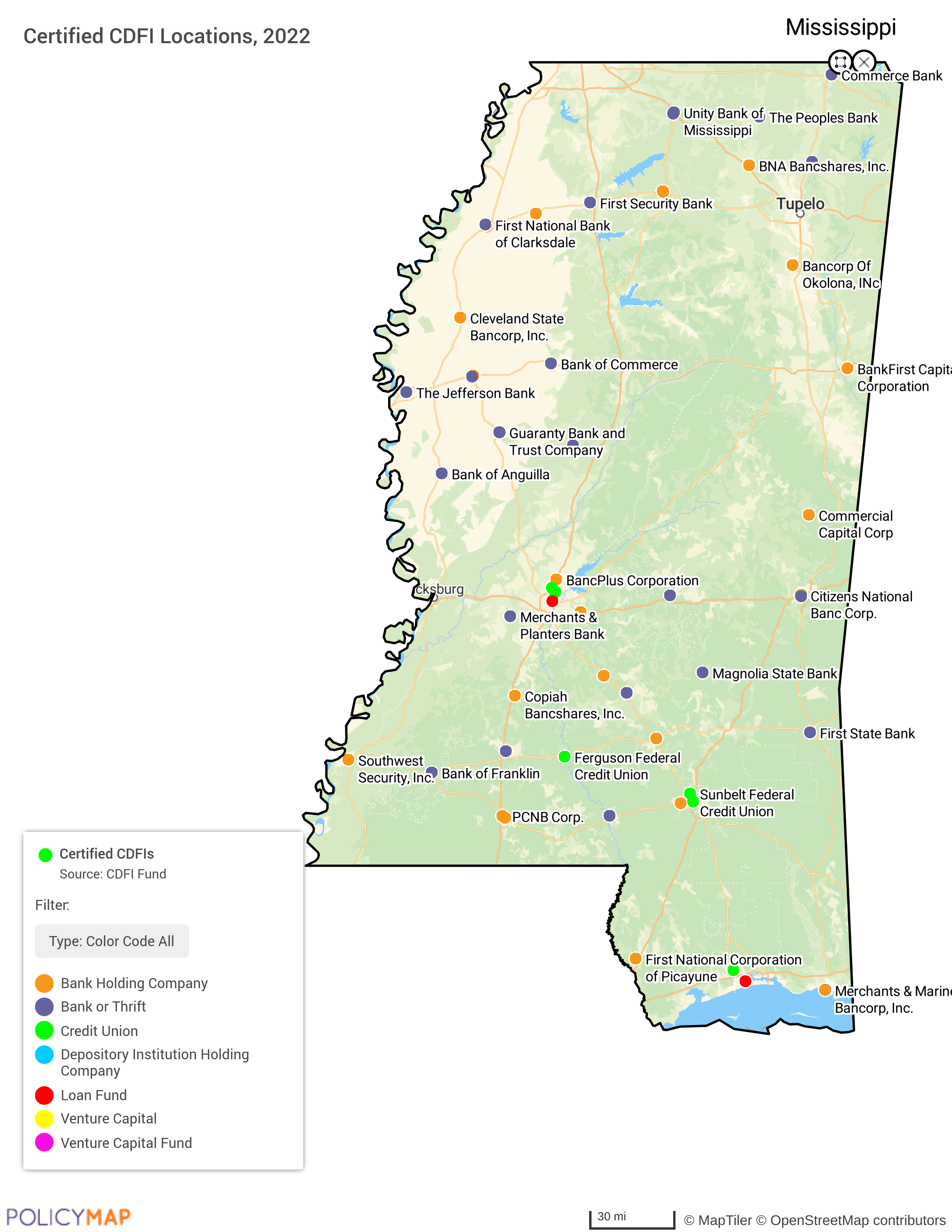

Mississippi is home to 81 CDFIs; 45 of which are credit unions or banks.

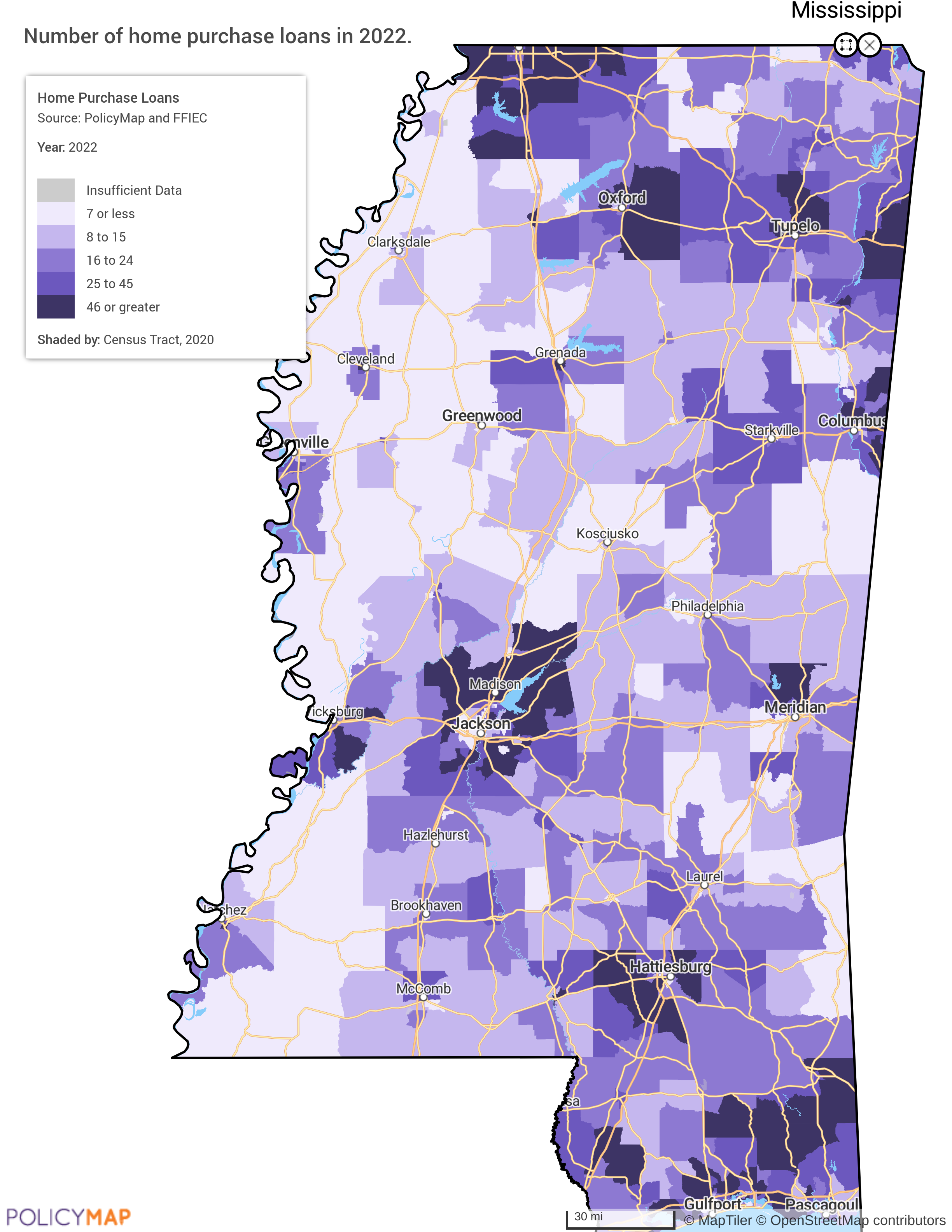

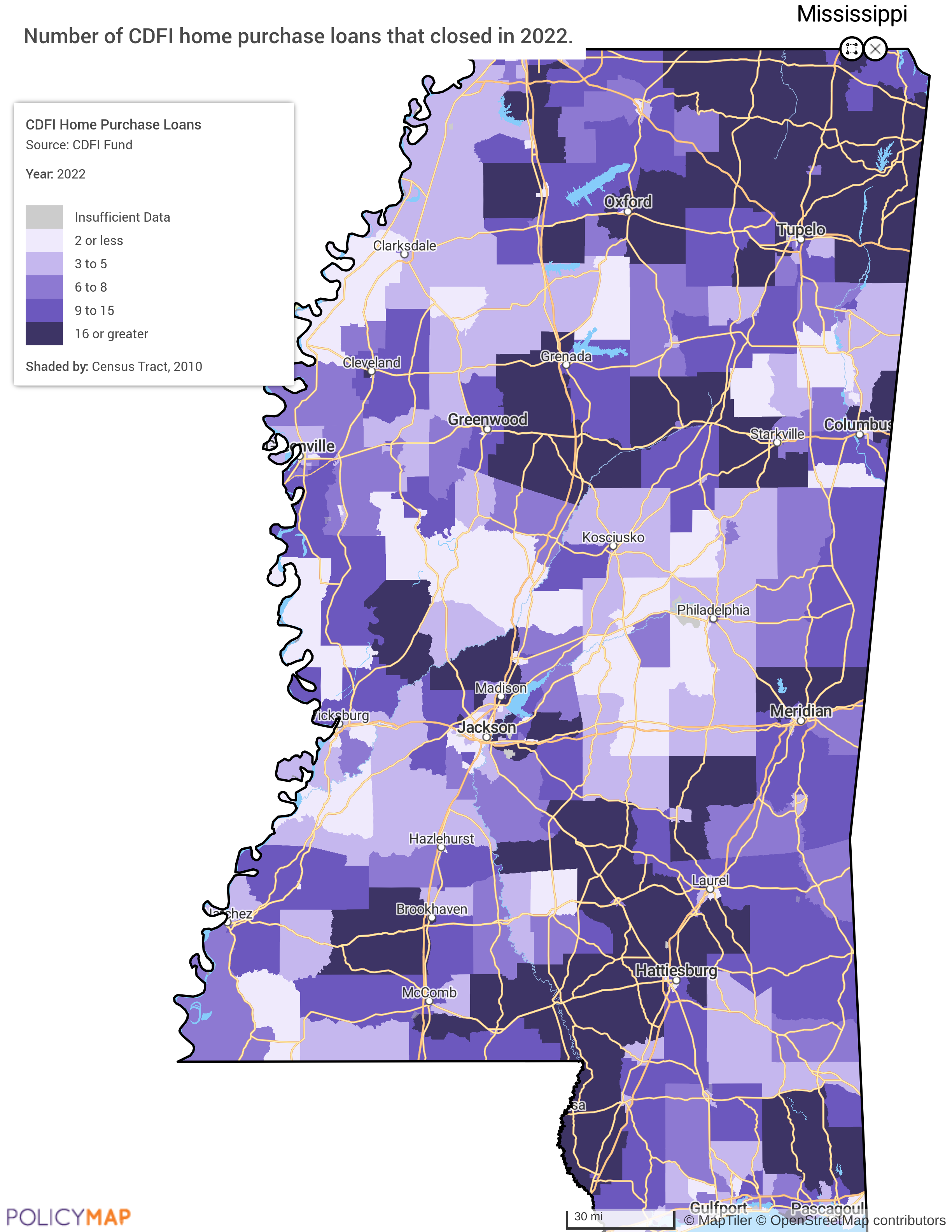

Data from the FFIEC Home Mortgage Disclosure Act (HMDA) for 2022 reveals that home purchase loans made by all lenders were heavily concentrated in and around larger cities. These concentrations are shown in the darkest purple on the map that follows.

CDFI-involved loans in Mississippi, however, were more evenly distributed across the state. This suggests that CDFIs played a vital role in expanding homeownership beyond urban centers, reaching households in more rural or underserved areas. These areas of concentration are shaded in dark purple on the following map.

The impact of CDFIs on homeownership is undeniable. By providing accessible financing, down payment assistance, and financial education, CDFIs empower individuals and families—especially those in underserved areas—to achieve the dream of homeownership. Their presence, particularly the presence of credit unions and banks, can help to ensure that economic opportunities extend beyond major cities and into rural and lower-income communities that traditional lenders often overlook. As discussions continue about the future of CDFI funding and policies, it’s essential to recognize their role in strengthening communities, promoting financial opportunity, and driving economic growth.

Request More Information

Do you want to better understand the role CDFIs play in your community? Interested in digging deeper to learn how recent policy changes may impact the areas where you work? Fill in the form below to request more information. We’ll be in touch in short order.