Where Baby Boomers Are Booming: The Silver Wave Reshaping America’s Economic Landscape

Imagine a small town in Maine where nearly one in four residents is over the age of 65. Local hospitals are stretched thin, the housing market is adapting to new demands, and businesses are rethinking their services to cater to an aging clientele. As the Baby Boomer generation enters retirement, this scenario is becoming increasingly common across the United States.

The demographic shift, often called the “Silver Wave,” is not uniform across the country. Certain regions are experiencing higher concentrations of older adults, leading to distinct economic and social implications. Understanding these patterns is crucial for policymakers, businesses, and communities aiming to navigate the challenges and opportunities presented by an aging population.

Defining the “Silver Wave”

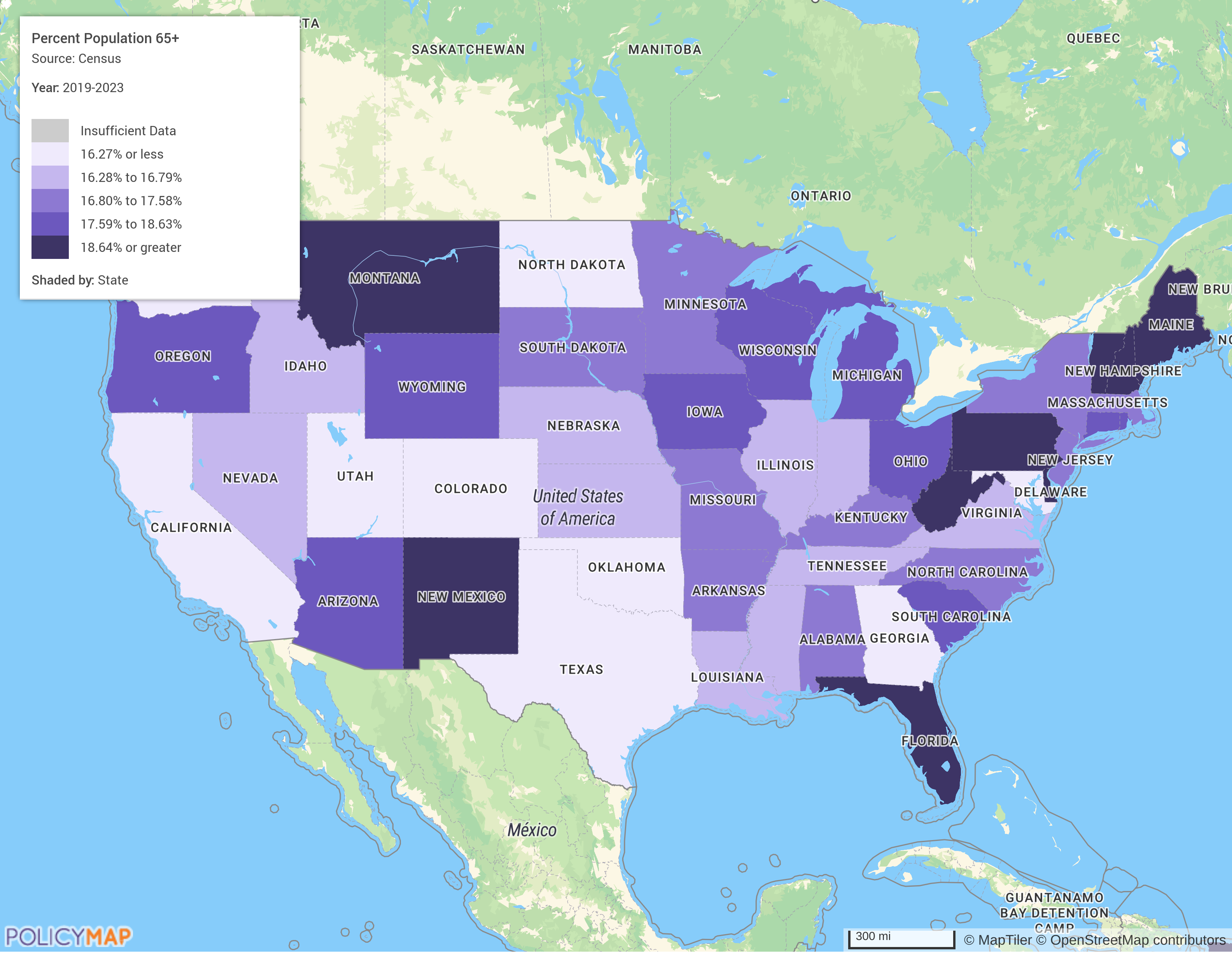

According to the 2019-2023 American Community Survey Data provided by the Census, the states with the highest percentages of residents aged 65 and older are:

- Maine: 21.86%

- Florida: 21.12%

- Vermont: 20.79%

- West Virginia: 20.68%

- Montana: 19.70%

- New Hampshire: 19.49%

- Pennsylvania: 19.07%

- New Mexico: 18.78%

These states are shaded in the darkest purple on the map below.

As Baby Boomers continue to age, their growing presence places widespread pressure on key systems across the country–especially in states with high concentrations of older adults. Healthcare networks are feeling the immediate strain, with limited staffing, space, and a projected shortage of up to 48,000 primary care physicians by 2034. Many seniors also require more specialized, long-term care due to chronic conditions, further stretching provider capacity. But the impact goes beyond healthcare. Aging populations are also reshaping local housing markets and labor force dynamics, raising urgent questions about affordability, accessibility, and economic sustainability. Understanding these overlapping challenges is essential to preparing communities for the full scope of the Silver Wave.

Let’s dig deeper, focusing on four states: Maine, Florida, Vermont, and Montana.

Reading Break: Request A Demo

Curious about how the shifting demographics of America’s aging population could affect your community’s future? Whether it’s healthcare access, housing development, or workforce planning, PolicyMap offers the data and tools to help you make informed, impactful decisions. Use the form to request a personalized demo and see how our platform can guide you in addressing these challenges with precision and equity.

Economic Implications of an Aging Population

Healthcare Accessibility Metrics

In states like Florida, Maine, Montana, and Vermont, where seniors make up a large share of the population, healthcare systems face added pressure due to geographic and demographic challenges. Rural areas, especially in Montana and Vermont, often lack nearby hospitals and face limited transportation and broadband access. Even in more urban retirement hubs like Florida, the growing senior population strains existing facilities, leading to longer wait times and higher costs. Addressing these issues will require expanding care options, offering mobile health services, and incentivizing providers to work in high-need areas.

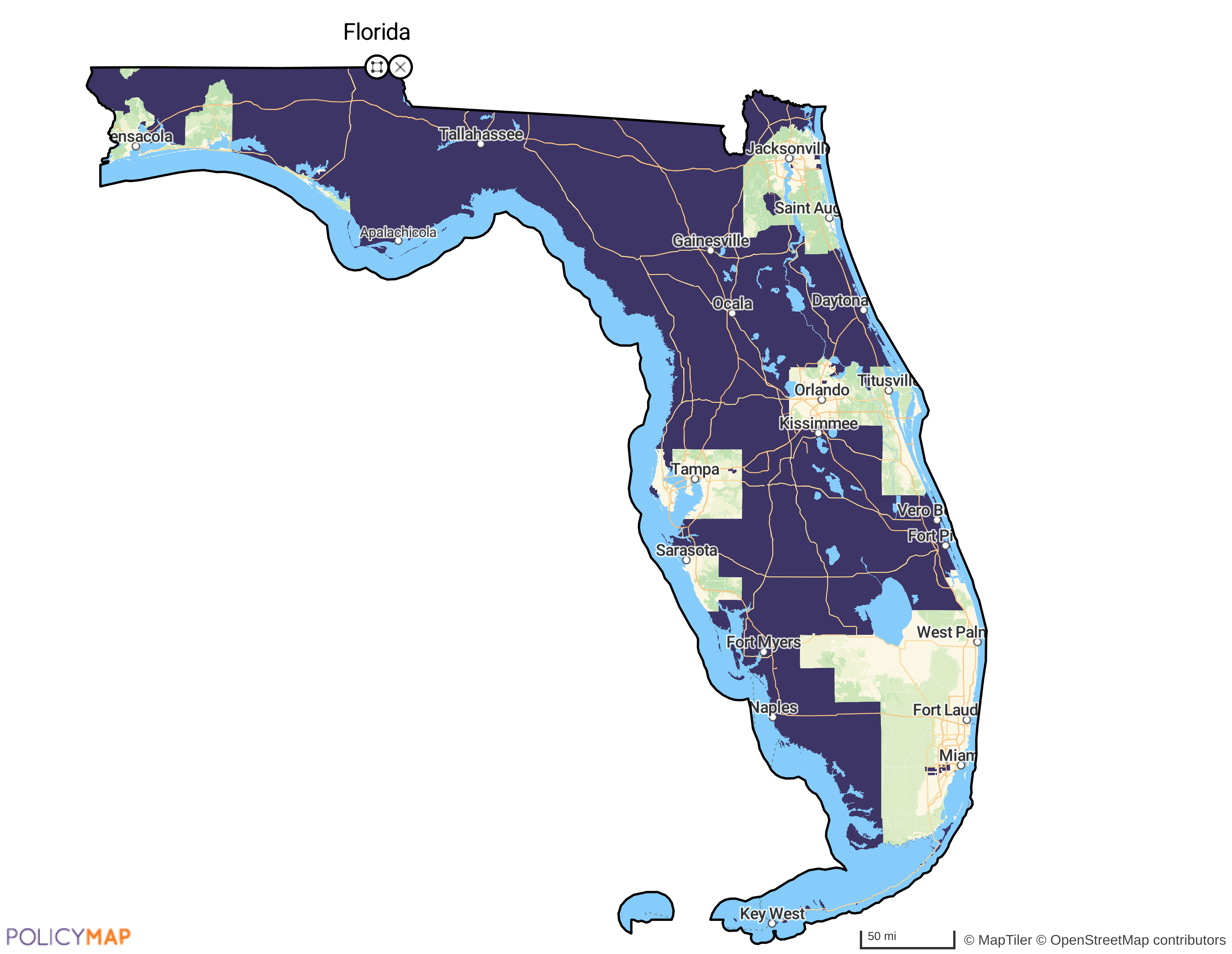

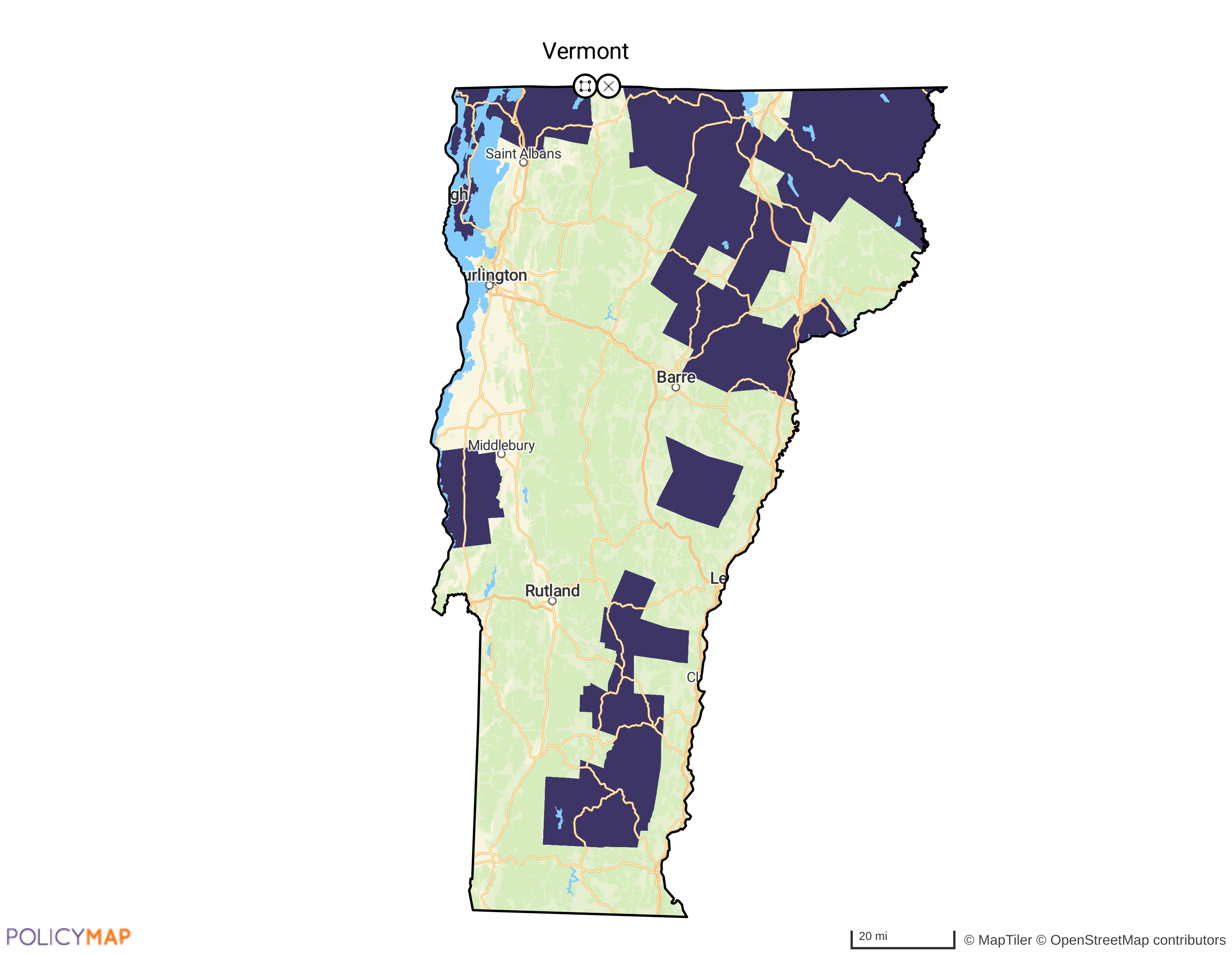

One way to assess gaps in healthcare access is through the federal designation of Medically Underserved Areas (MUAs). These are identified by the Health Resources & Services Administration (HRSA) based on provider shortages, poverty rates, and other factors. Many counties in the four highlighted states fall into this category, signaling deeper systemic access issues. The maps below show Florida, Maine, Montana, and Vermont, highlighting their MUAs, with Vermont experiencing fewer shortages.

Housing Market Indicators

The aging population is reshaping housing demand, especially in states with high senior concentrations like Florida, Maine, Montana, and Vermont. Older adults increasingly seek homes that support aging in place—single-floor layouts, accessibility features, and proximity to essential services. While none of these four states rank among those with the nation’s oldest housing stock overall, which is encouraging, there are important differences within the group. According to ACS data from 2019–2023, Maine has the oldest median housing stock of the four, followed by Vermont and Montana, while Florida has the newest. Still, much of the available housing in these states remains ill-suited for aging residents, creating local pressure to retrofit older homes and expand accessible housing options. The map below visualizes these patterns, with darker browns indicating older housing stock and lighter shades representing newer construction.

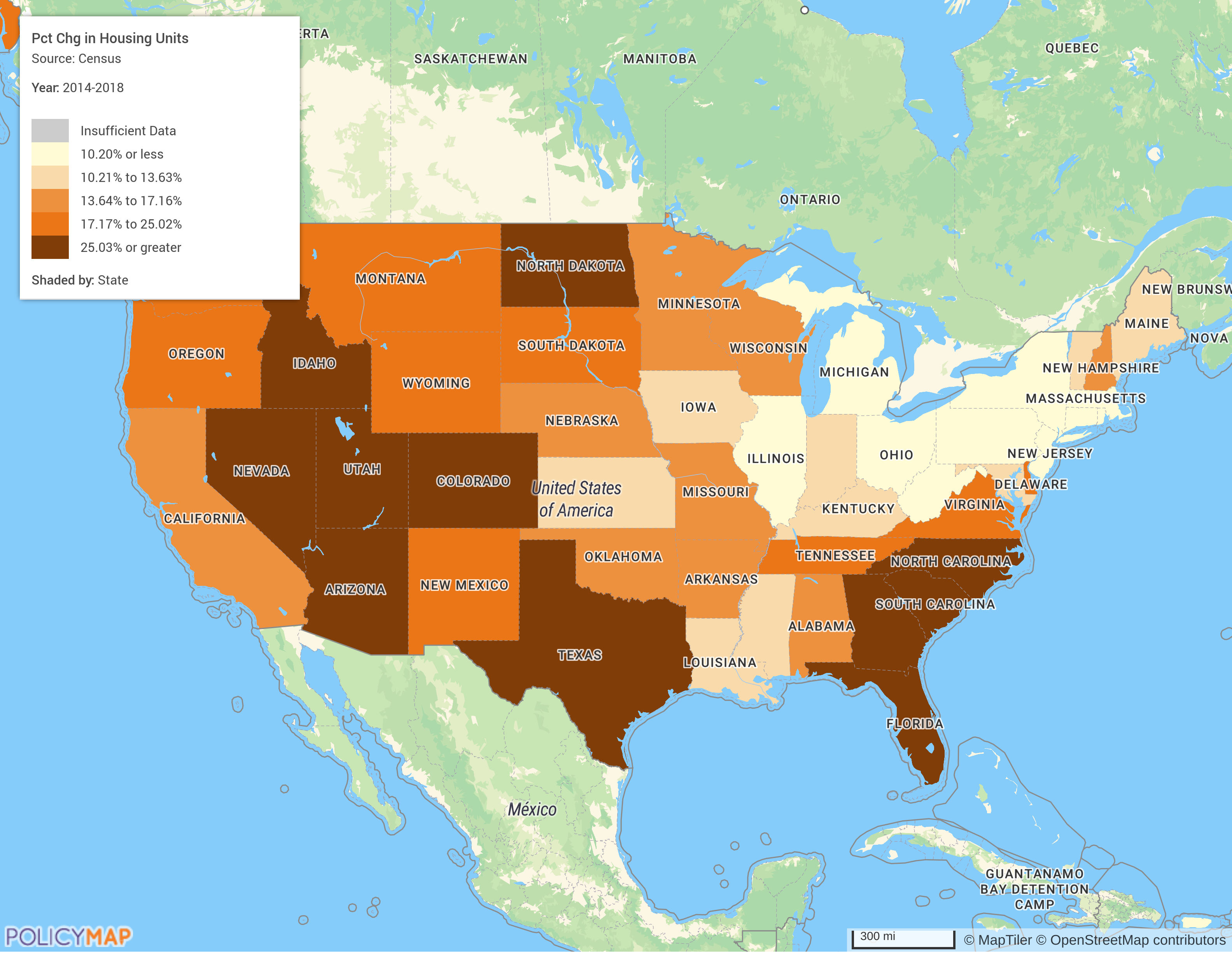

To understand how states are responding to shifting housing needs among older adults, it’s important to examine recent growth in housing supply within the United States. The percent change in the number of housing units offers a clear measure of where new construction is occurring—and where it’s lagging. This indicator highlights which states are actively expanding their housing stock to better support aging populations. According to the ACS, Florida shows a strong increase in housing unit growth, which is a positive sign given its large senior population. In contrast, states like Maine and Vermont have seen minimal growth, suggesting limited new construction that could modernize or expand accessible housing options. Montana sits somewhere in between, with modest gains that reflect gradual improvements to its housing stock. The map below illustrates these trends, highlighting which states are responding to changing housing demands.

With a limited housing supply that provides the accessibility needed, affordability is a growing concern as many seniors live on fixed incomes and face rising housing costs. In several counties across these states, more than 30% of older homeowners are considered housing cost-burdened, spending a significant portion of their income on housing alone. In addition, the inventory of affordable senior housing, including assisted living and independent living facilities, remains limited. These trends point to a need for targeted investment in age-friendly housing and zoning reforms that support accessible housing development in both urban and rural areas. The map below shows the affordability concerns in key states. Florida, Vermont, and Maine have a higher percentage of older homeowners burdened by housing costs. Montana seems to be the most affordable state for seniors.

Economic Development Strategies

The economic participation of older adults presents both a challenge and an opportunity for states with aging populations. As the map below illustrates, several states with high senior concentrations, such as Florida and Maine, also show elevated rates of unemployment among people aged 65 and older. While in general the unemployment rate for seniors is relatively low, this may suggest that there are older adults in some states seeking work who are unable to find suitable opportunities. This may reflect mismatches between job availability, age-friendly employment practices, and senior workers’ skill sets.

Organizations seeking to address this must develop workforce development strategies that include older adults. This could mean offering targeted upskilling programs in areas like digital literacy, caregiving, and remote work technologies that align with today’s job market. At the same time, business attraction efforts might prioritize industries that can integrate older workers, such as healthcare, education, or consulting, by offering flexible, part-time, or remote roles. Tax base sustainability also comes into play. With many retirees on fixed incomes and less active in the workforce, states must diversify their economies to ensure stability. Investing in sectors like telehealth, senior tech, and home retrofit services could simultaneously meet the needs of an aging population and revitalize local economies.

Designing for a Greying Nation

The Silver Wave is more than a demographic shift—it’s an urgent call to reimagine how we design, build, and sustain our communities. As states like Maine, Vermont, Montana, and Florida experience disproportionate growth in their 65+ populations, the economic and infrastructure implications ripple across healthcare systems, housing markets, and labor forces.

To meet this moment and effectively respond to the growing economic and social pressures of the Silver Wave, policymakers, businesses, and communities must make intentional investments guided by data and rooted in equity. This could mean upgrading healthcare access, modernizing housing supply, and preparing both older and younger workers for the evolving job landscape. With coordinated, strategic planning, communities can transform the challenges of aging into opportunities to build healthier, more inclusive, and future-ready environments.

Request More Information

The Silver Wave is reshaping communities, presenting both challenges and opportunities across healthcare, housing, and labor markets. Contact us today to see how PolicyMap can provide the data and insights you need to guide equitable, strategic investments. Fill out the form to request information, schedule a demo, or explore pricing options.