How Healthcare Organizations Can Leverage Opportunity Zones for SDOH Funding

The U.S. House of Representatives passed a budget resolution on February 25, 2025, which sets a framework consistent with the administration’s conversations regarding an extension and expansion of the Opportunity Zone (OZ) program. An OZ is a designated geographic area, typically a low-income community, identified by state governments and certified by the U.S. Department of the Treasury to spur economic development and investment. Established under the 2017 Tax Cuts and Jobs Act, the OZ program provides tax incentives to spur investment in economically distressed communities. These incentives have not only driven housing development but also attracted investments to strengthen healthcare services and address the broader social determinants of health.

💡Dig Deeper with PolicyMap

How do Opportunity Zones work?

Opportunity Zones work by offering tax incentives to investors who reinvest their capital gains into qualified projects or businesses within these designated zones through Opportunity Funds. Investors can defer taxes on their original capital gains until the end of 2026, reduce their tax burden if they hold the investment for at least five years, and eliminate taxes on any new gains from the investment if held for ten years. These tax benefits aim to attract sustained investment, encouraging the development of affordable housing, job creation, and other initiatives that benefit both investors and local communities. The program seeks to align private financial goals with public economic revitalization efforts. Learn more about how PolicyMap helps organizations locate key census tracts for development projects across industries.

Using Opportunity Zones to Address Social Determinants of Health

Opportunity Zone tax benefits are currently set to expire in 2026. An extension of the tax credit and an expansion of the program aims to attract up to $50 billion in new investments into the nation’s poorest neighborhoods. It also aims to extend benefits to underserved rural areas.

Tax incentives in OZ were designed to encourage long-term investments in economically distressed areas by offering significant federal tax benefits to investors. In some areas, communities used these tax incentives to bring investment to projects that address underlying social determinants of health issues, including affordable housing development, health care access, food security, job training, and housing repairs – key social determinants of health.

Two examples of how these tax credits have been used to address underlying social determinants of health involve PolicyMap customers as follows:

Erie, Pennsylvania: The Hamot Health Foundation & UMPC

Erie utilized OZs to attract investments for revitalizing its downtown and addressing health disparities in underserved neighborhoods. The Hamot Health Foundation and University of Pittsburgh Medical Center (UPMC) Hamot focused on improving social determinants of health by investing in affordable housing, green spaces, housing repairs, and neighborhood infrastructure, including a physician’s office. OZ funds played a crucial role in facilitating these developments, contributing to improved community health outcomes.

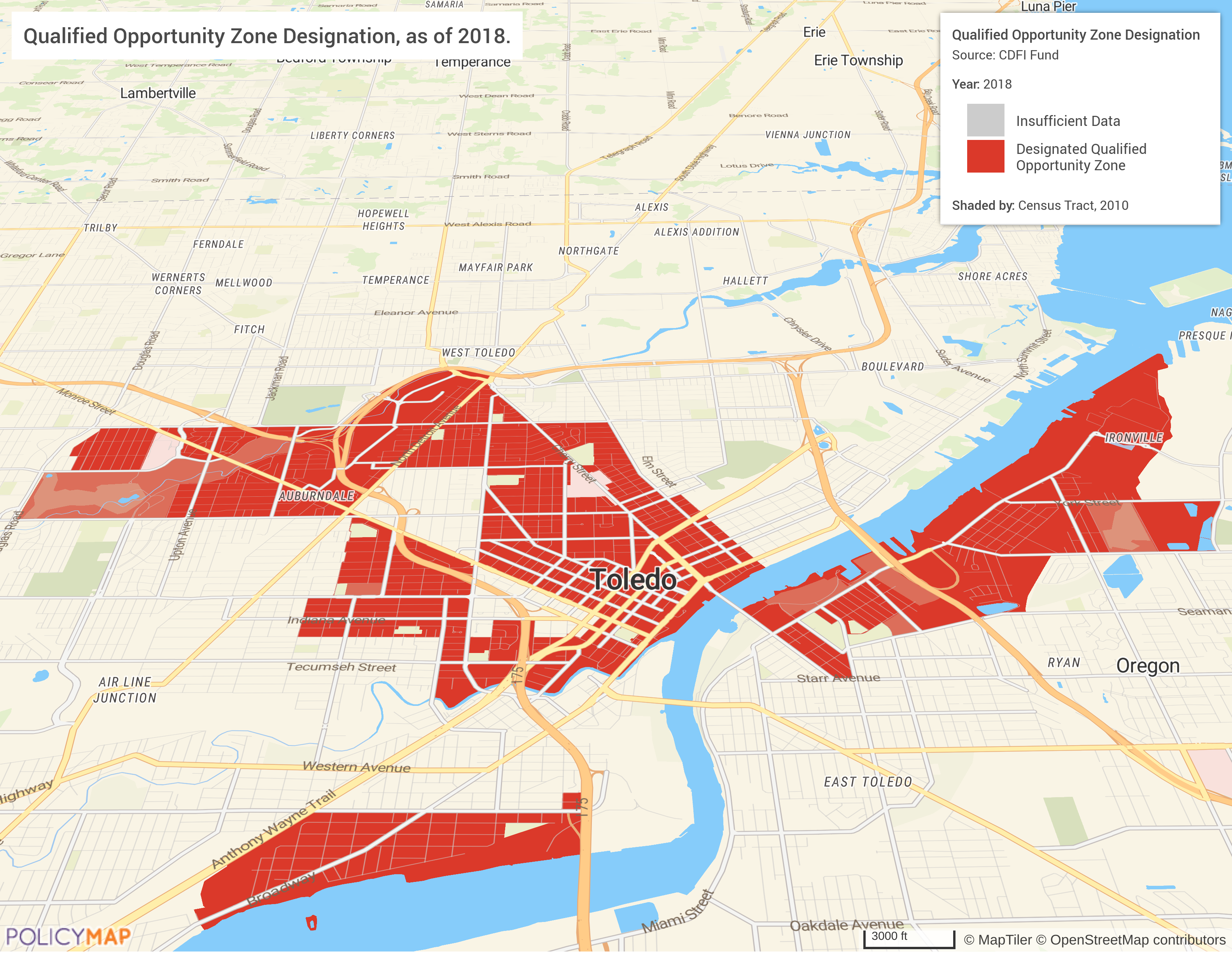

Toledo, Ohio: ProMedica & The Local Initiatives Support Corporation

In 2018, the nonprofit health system ProMedica partnered with the Local Initiatives Support Corporation (LISC), a national community development financial institution, to launch a $45 million initiative aimed at revitalizing underinvested communities in the greater Toledo area. The initiative focused on revitalizing underinvested communities in the greater Toledo area by supporting job training, employment skills, education, and food security. OZ incentives attracted additional capital, amplifying the impact of these investments. Notably, more than half of the sites involved in their initiatives, including the ProMedica program, were located within federally designated Opportunity Zones.

Locate Investment Areas within OZs with Multi-Layer Maps

💡Dig Deeper with PolicyMap

Where to find maps of Opportunity Zones?

PolicyMap’s interactive platform helps investors, policymakers, and organziation across industries quickly locate Opportunity Zones and visualize qualified areas alongside other relevant data layers, such as social determinants of health, including affordable housing development, health care access, food security, job training, and housing repairs.

If OZs do become the central method for channeling investment in underserved areas, knowing their geographic location, understanding the needs of their neighborhoods, and the landscape of existing assets becomes crucial as communities work to attract these types of investments.

As an example, with PolicyMap, a health care provider looking to establish obstetrics services in areas with high rates of maternal vulnerability and high levels of poverty can identify those areas that are also in Opportunity Zones as a means of bringing additional investment dollars to their project. Neighborhoods in and around Kansas City which meet these criteria are highlighted in purple on the map above.

Request More Information

Proposed expansions to Opportunity Zones could bring new funding opportunities to healthcare organizations tackling Social Determinants of Health (SDOH) like access to care, food security, and housing stability. Traditionally geared toward housing and commercial development, Opportunity Zones now offer a powerful way to align community investment with health-focused initiatives.

This expansion presents a pivotal moment for healthcare organizations to integrate SDOH solutions into broader economic strategies. Learn how to identify Opportunity Zones and tap into this funding potential. Contact us using the form below.