How We Used the Moody’s Analytics Housing Gap Data to Craft a $2 Billion, 30,000 Unit Housing Plan in Philadelphia

This article was written by Angela Brooks, Chief Housing & Urban Development Officer, City of Philadelphia; Jessie Lawrence, Director, Department of Planning & Development, City of Philadelphia; and Ira Goldstein, Senior Advisor, Policy Solutions Group, Reinvestment Fund.

It is difficult to make good policy and wise investment of public funds without sound data, objectively and rigorously analyzed, and that is why the housing gap measures are so foundational to Philadelphia’s Housing Program, HOME.

A Housing Plan for Philadelphia

Philadelphia candidate for Mayor Cherelle L. Parker promised that if elected Mayor, she would create or preserve 30,000 housing units. This bold promise was made because we are living in a moment when the breadth and depth of the housing challenges facing Philadelphians (and families across the nation) are extraordinary. In Philadelphia, we have the related problems of availability and affordability. That is, we are short housing units in many segments of the Philadelphia housing market, and the housing units that we do have are financially out of reach for far too many of us.

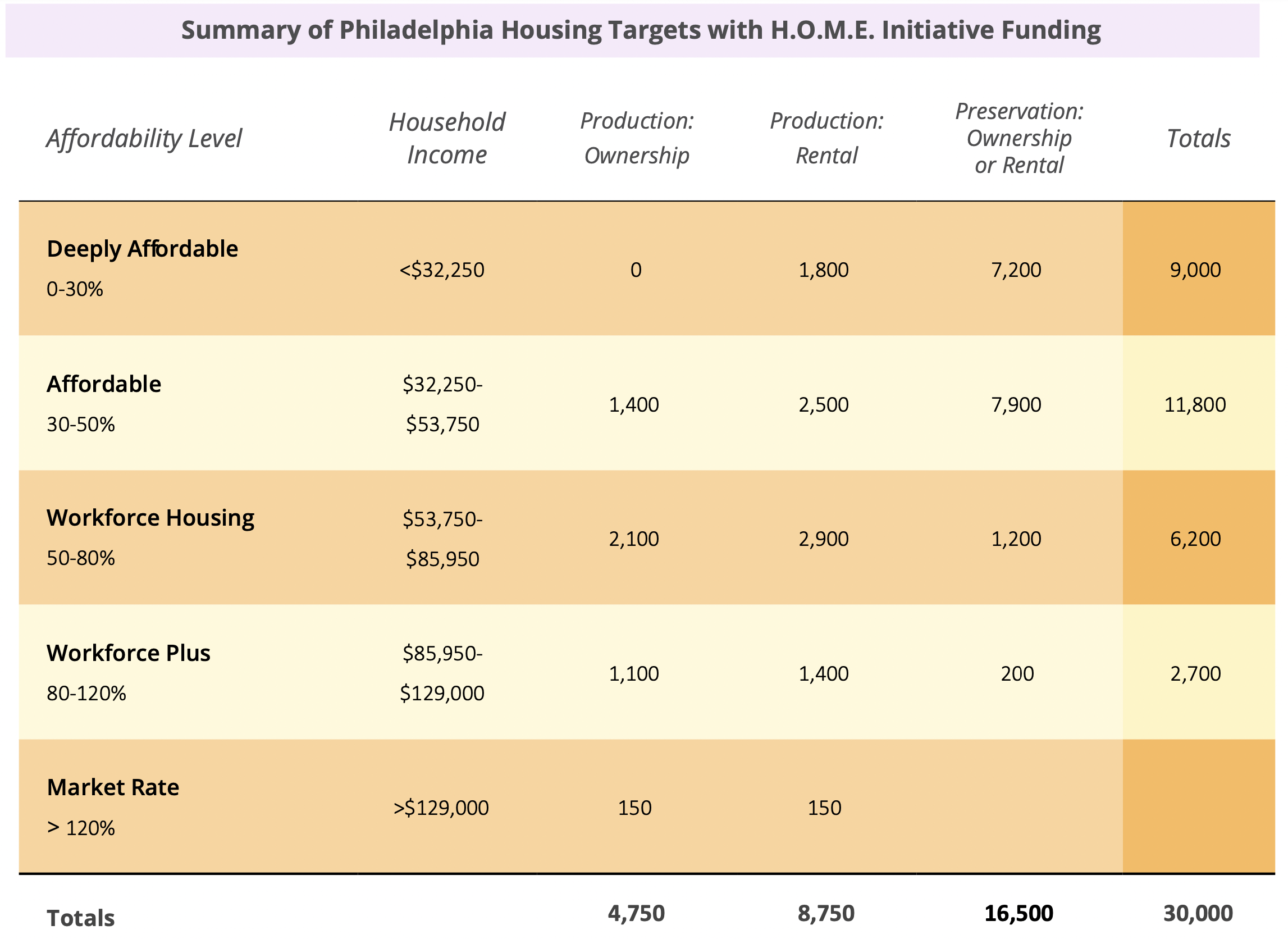

Approximately six months into her first term as Mayor, Parker tasked her leadership team with producing a concrete plan to address the multiple dimensions of Philadelphia’s availability and affordability challenges. This plan, named Housing Opportunities Made Easy (H.O.M.E.), relies on more than $2 billion to achieve its 30,000-unit goal. Funding for HOME includes the sale of $800 million in bonds (two tranches of $400 million, sold as bond proceeds are invested). Further, the City will invest in public land, valued at $1 billion. Also supporting HOME are funds from HUD (e.g., CDBG, HOME, HOPWA, ESG), the City’s General Fund, philanthropy, and outside investments. Taken together, these funds will support the creation of 13,500 new homes and the preservation of 16,500 homes. These targets will be accomplished through the continuation, or enhancement of, existing programs as well as some new programs and products meant to address one or another of the demonstrable housing issues confronting Philadelphians. Aside from the financial investment, the City undertook a critical self-examination of its agencies and processes. All will implement policy, legislative, and procedural changes designed to reduce the time and expense associated with the creation or preservation of housing.

More than 9-in-10 of Philadelphia’s lowest-income renters cannot afford to pay their rent and have sufficient money left over each month to pay for other necessities. Using official standards of cost burden: 29% of Philadelphia’s renters are extremely cost burdened (i.e., spending more than 50% of their income on rent); another 23% are cost burdened (i.e., spending 30-49.9% of their income on rent). 68% of lower-income renters – those making $35,000 or less – are extremely cost burdened, and another 20% are cost burdened.

In Philadelphia, the monthly mortgage cost for a typical home rose by 61% between 2019 and 2024, and the down payment requirement rose by 37%. The median home sale price in 2024 in Philadelphia was $240K; a 37% increase since 2019. And, for the lower quartile of home prices (i.e, the least expensive homes), the median price of $145K in 2024 represents a 56% increase since 2019. Between rising interest rates and home prices, the cost of entry for the typical home in Philadelphia in 2024 was $24,000 (representing a 10% down payment) with an estimated $1,880/month mortgage (not including taxes). In 2019, a buyer only needed $17,500 for the down payment and the ability to pay a $1,169/month mortgage (not including taxes).

So, how did we arrive at creating a goal of creating 13,500 new units and preservation of 16,500 more?

Quantifying Local Need with Housing Unit Gap Estimates by Moody’s Analytics

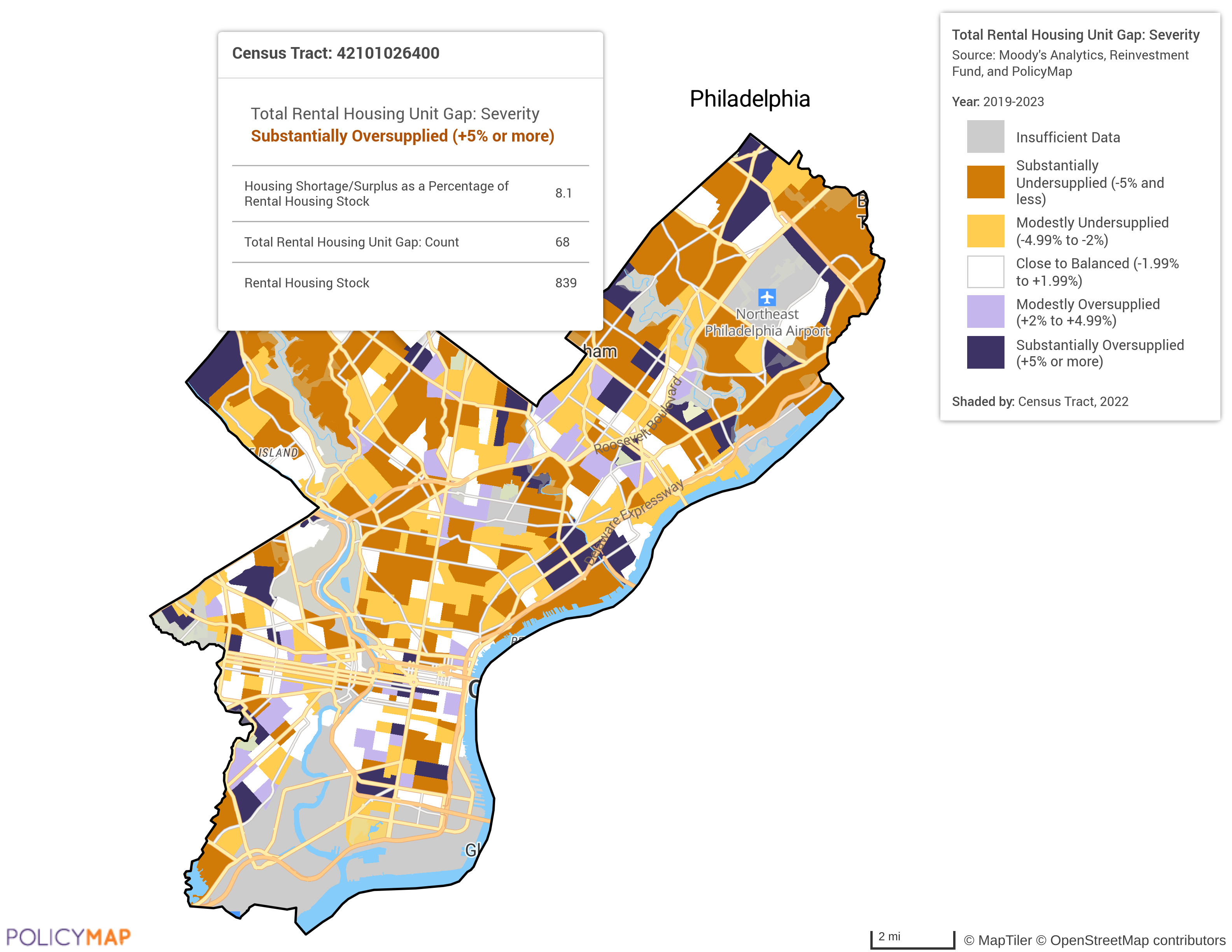

The new unit goal in Philadelphia’s Housing Plan relies on housing unit estimates created by the research team of Moody Analytics, PolicyMap, and Reinvestment Fund’s Policy Solutions group. The housing unit estimates are created based on the notion that markets have normal or equilibrium vacancy rates. When current vacancy rates are lower than the equilibrium rate, the market has a gap or shortage of units. Conversely, when current vacancy rates are higher than the equilibrium rate, there is a surplus of units.1 The preservation unit goal relies on a different methodology rooted in multiple indicia of property condition challenges (e.g., code violations, property condition as measured by the City’s Office of Property Assessment). By addressing 78% of the estimated need for new and 78% of the need for preserved units, the City can meet the Mayor’s goal of 30,000 units.

Because the housing gap estimates are created for tracts, we have been able to:

- Visually observe where the gaps are more or less acute across the city, and the income levels of existing residents.

- Apportion where and for whom those 13,500 new unit developments are targeted.

- Identify what financial tools are needed to create units in differing neighborhoods. Units targeted for the lowest-income Philadelphia households will undoubtedly need more and different forms of support than, for example, units created for Philadelphians in the “workforce plus” income ranges. This kind of economic breakdown of the shortage supports informed HOME budgeting by matching estimated need to funding streams contemplated in HOME.2

Important to HOME has been the realization that while Philadelphia is short on housing units, not all parts of Philadelphia are undersupplied. In fact, many of the oversupplied areas are places where the private market has created thousands of units over the last few years, many of which now sit vacant. For example, the supply of homes for owner-occupants in the area around the city’s downtown core, the “hot market” River Wards along the Delaware River, and parts of South Philadelphia (e.g., Graduate Hospital and Point Breeze) have an oversupply. On the other hand, there are parts of the city that are short on owner housing units. Virtually the entire Northeast and Northwest sections of Philadelphia have a modest need for owner-occupied housing.

Total Owner Housing Unit Gap in Philadelphia, PA

Total Rental Housing Unit Gap in Philadelphia, PA

On the rental side, we see many more areas with an acute rental shortage, along with several communities where we are overbuilt. For example, there are substantial rental housing gaps in the Northeast and Northwest sections of the city. Much of Northeast and Northwest Philadelphia is home to Philadelphia’s middle-class residents (i.e., Philadelphia’s middle neighborhoods), especially the stable Black middle-class communities in Northwest Philadelphia and the growing immigrant working and middle classes in Northeast Philadelphia. But we also have some substantial gaps in parts of North and Eastern North Philadelphia, long home to Philadelphia’s lower-income families, people of color, and immigrant families. In short, the market has done reasonably well serving the highest income residents, but not as well those who are not so economically fortunate.

A Data-Driven Housing Plan and Program Using Housing Gap Estimates

The guiding principle of Mayor Parker and the HOME program is the use of the best available data and metrics. The Housing Gap estimates are now a cornerstone of a data-driven housing plan for Philadelphia, and they have helped the Mayor demonstrate the magnitude and dimensions of the need when working with City Council to authorize the unprecedented action of an $800 million borrowing for housing. Like any responsible legislative body, the Philadelphia City Council asked substantive, pointed questions about the Plan, and this set of housing metrics allowed the Mayor’s team to paint a picture of the housing need and the way it cuts across multiple tenure types and income strata.

Now that the Plan has been approved and is in the early implementation phase, because the estimates are based on data from 2023, the City will overlay recently issued building permits and certificates of occupancy associated with new construction and preservation on the housing shortage/surplus maps. In this way, the City can determine if current new development activities have or will address an identified gap.

Additionally, the shortage gap estimates will be used in the following ways:

- The City will overlay recently issued building permits and certificates of occupancy associated with new construction and preservation on the housing shortage/surplus maps. In this way, the City can determine if current new development activities have or will address an identified gap.

- Connecting gap measures to household income summarized at the tract level allows the City’s HOME team to apportion its financial tools and programs commensurate with the need. For example, for those lower- and middle-income Philadelphians (in particular) aspiring to homeownership, HOME is seeking to amp up the effective demand of these families through downpayment and closing cost assistance programs such as Philly First Home and a new mortgage program, One Philly Mortgage, modeled after the Massachusetts ONE Mortgage program. These programs, considered together, enhance effective demand through grants for downpayment and closing cost assistance, reduced need for PMI, discounted interest rates, and pre- and post-purchase counseling.

- The City currently owns a substantial portfolio of land parcels, and it anticipates acquiring more land through a repurchase of tax liens it sold decades ago to raise general funds. Mapping those parcels of land on top of the estimated gaps, along with other measures of market strength such as Reinvestment Fund’s Market Value Analysis, will enable the HOME team to make effective, strategic decisions about how it can support the creation of housing units that are accessible and affordable to a variety of households along the income spectrum. Jointly understanding need and market strength can also inform the terms under which those public parcels are made available for development. Hopefully, gone are the days when the City provides subsidies to developments that would happen without such support, robbing scarce resources from developments that desperately need support to reach the tenure types and levels of affordability needed. Make no mistake: $2 billion is a lot of money, but over-subsidizing development will threaten the ability to achieve the Mayor’s ambitious goal.

- Lastly, the HOME team maintains that transparency is key to effective community participation in decision-making and in holding itself responsible for its promises. To that end, the City is creating a dashboard that will, when complete, display HOME-funded activities against the targets built on the gap estimates; the plan is also to present HOME activities in map form, giving greater and more accessible detail to the public. The public expects this measure of transparency, and HOME will provide it.

It is difficult to make good policy and wise investment of public funds without sound data, objectively and rigorously analyzed, and that is why the housing gap measures are so foundational to HOME. Each year, the gap measures will be updated by the study team and will serve as one of the multiple measures HOME and all Philadelphians use to judge HOME’s impact.

Let’s Build Smarter Housing Solutions Together

This localized housing gap data helped shape one of the nation’s most ambitious housing plans. If your city or organization is ready to turn data into targeted action, we’re here to help. Contact us to learn more about our housing data tools and how they can support your goals.

- Philadelphia’s normal vacancy rate is 4.77%; the owner rate is 7.41% and the renter rate, 2.47%. The detailed methodology is found here: https://www.phila.gov/media/20250603190557/HOME-Initiative_APPENDIX-A.pdf ↩︎

- Augmenting the targets for production and preservation under HOME is a plan by the Philadelphia Housing Authority (Opening Doors) to create and preserve 20,000 affordable units. HOME contemplates supporting Opening Doors with land and capital in support of that complementary goal. ↩︎