Medical Debt in America: Policy, Health, and Financial Impacts

How Local Policies Are Making a Difference, and Why Federal Policy May Undo It All

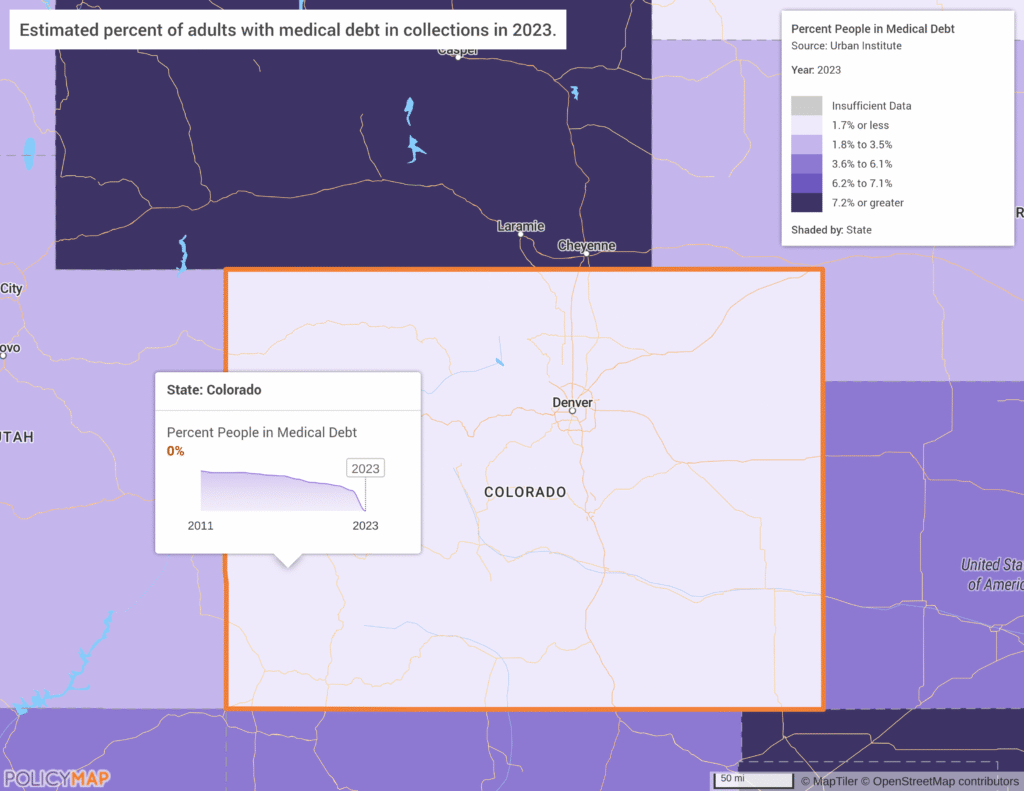

Millions of Americans are burdened with medical debt, often exacerbated by a lack of insurance or inadequate coverage. The Urban Institute medical debt landscape data offers a detailed look at how debt impacts communities across the United States – now available on PolicyMap.

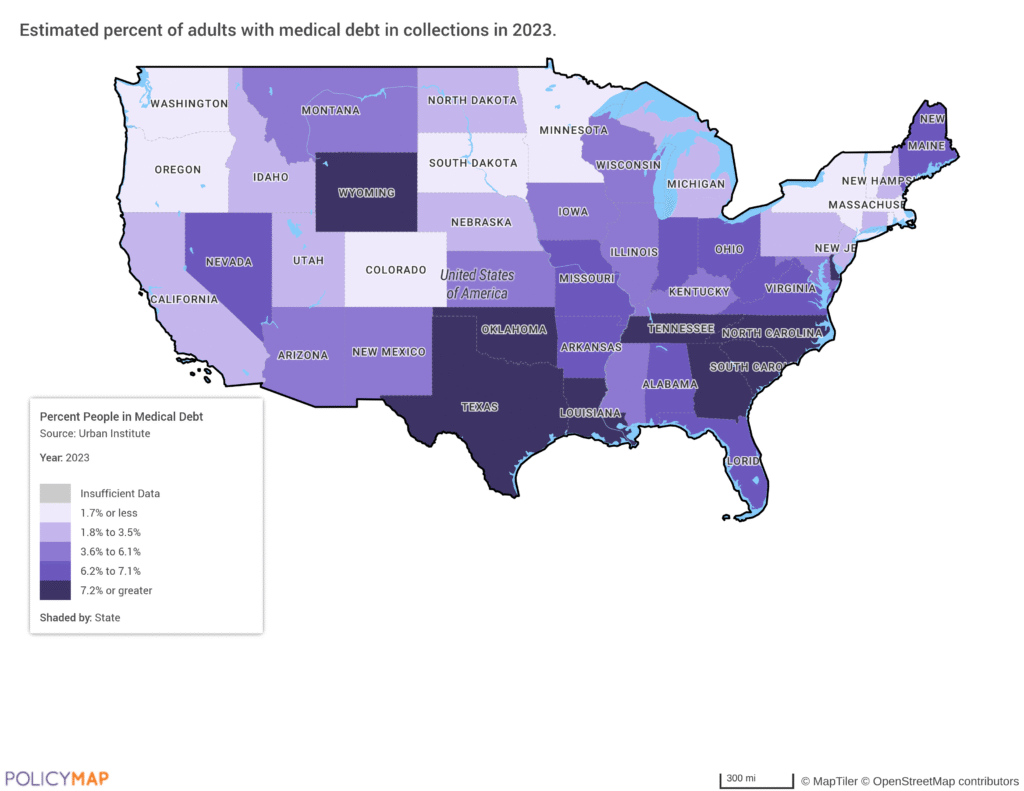

Medical debt is defined as unpaid medical bills that have been sent to collections. The impact of debt in collections can intensify financial stress, limit further access to medical care, and even worsen health outcomes. State and federal policies play a significant role in how people experience and manage medical debt.

Notice the lighter colors in several states, including Colorado and New York, which passed legislation to reduce or limit medical debt. Other states have enacted similar protections in recent years as more move to protect their residents from predatory medical debt practices.

In 2022, the three nationwide credit bureaus, Equifax, Experian, and TransUnion, announced that paid medical debts, medical debts less than a year old, and medical debt under $500 would no longer be included on consumers’ credit reports. The impact of these changes is evident in the data; there is a clear decline in 2023 medical debt data across the country in both the number of people in debt and the overall median medical debt.

In October 2025, the Consumer Financial Protection Bureau (CFPB) issued new guidance stating that federal credit reporting law generally overrides state-level policies, including those aimed at reducing the impacts of medical debt (Bloomberg Law, 2025). This represents a major change from prior guidance and comes as courts weigh the balance between federal standards and state protections under the Fair Credit Reporting Act (FCRA).

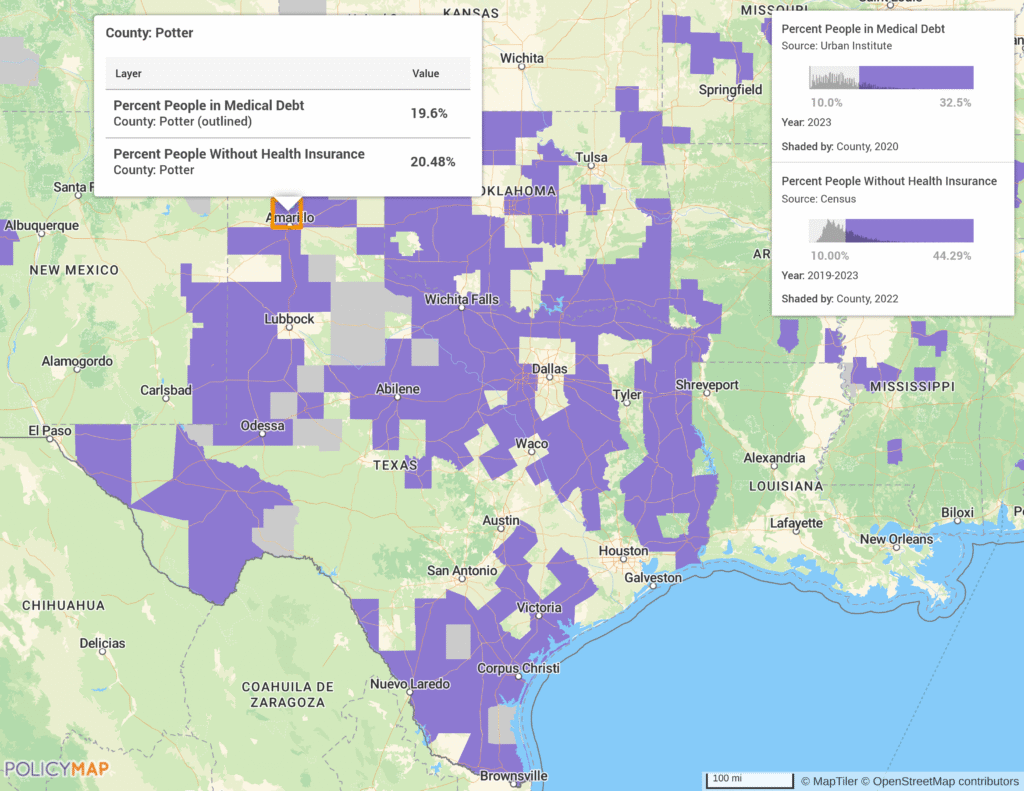

Access to Care and Insurance Coverage

Access to healthcare is a major driver of medical debt. Areas with high uninsured rates or underserved populations typically show higher shares of medical debt in collections. The Urban Institute estimates that 19.6% of people living in Potter County, Texas have medical debt in collections. According to the most recent American Community Survey (ACS) data, 8.55% is the national estimate for people without health insurance . Comparatively, Potter County has a rate of 20.48%, more than twice the national average. Lack of insurance can increase the likelihood of both accumulating medical debt and delaying care.

Research demonstrates that insurance gaps are strongly linked to financial stress and poorer health outcomes. These effects are often amplified in communities with lower incomes, limited healthcare infrastructure, and a higher prevalence of chronic conditions.

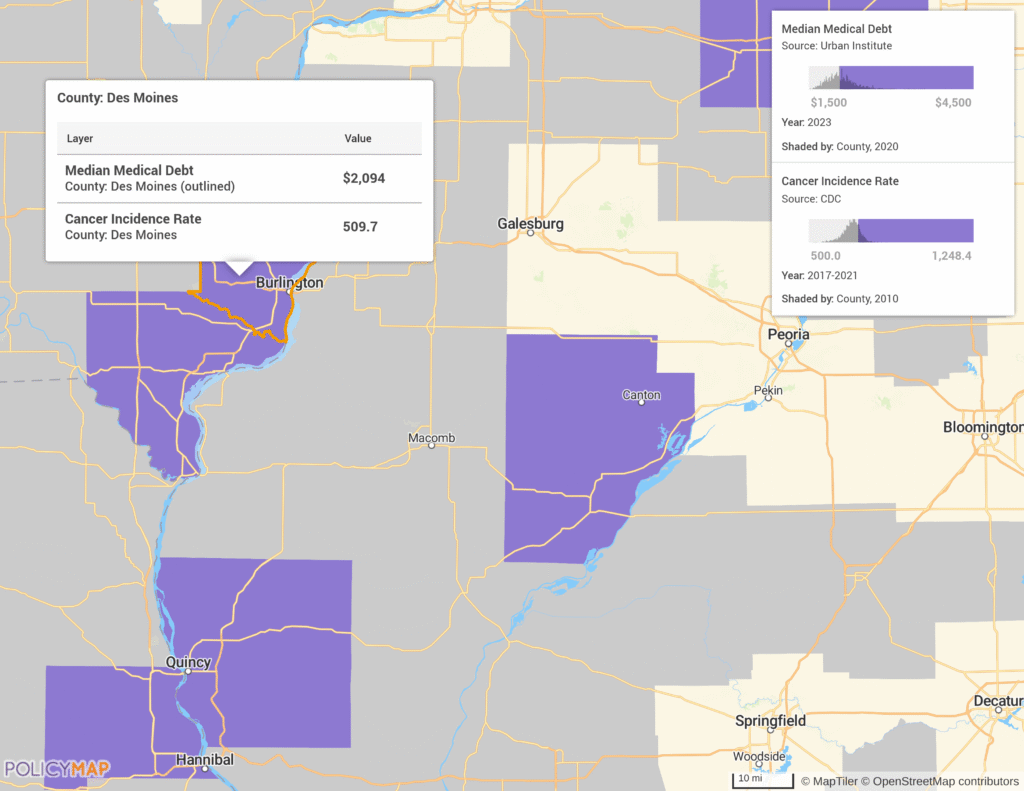

Medical Debt and Health Outcomes

Medical debt is not only a financial issue. People with medical debt are more likely to postpone or skip medical care, including preventive services and treatments for serious conditions. In some cases, delaying or foregoing cancer treatment can have severe consequences.

The National Cancer Institute defines financial toxicity as the financial distress directly related to out-of-pocket costs. With cancer being among the most expensive medical conditions in the United States, there is a much higher risk for financial toxicity. For example, a patient may skip a prescription or avoid going to the doctor to save money. Medical debt interacts with social determinants such as income, education, race, and local access to healthcare, compounding risks for vulnerable populations.

The map of Des Moines County highlights this relationship. The county has a median medical debt of $2,094 and a cancer incidence rate of 509.7 per 100,000 people.

Policy Changes and Their Impact

Many states have taken steps to reduce the burden of medical debt, demonstrating how local policies can directly affect financial outcomes. At least fifteen states now limit or prohibit the reporting of medical debt to credit bureaus, reducing its impact on residents’ credit profiles.

- In November 2025, North Carolina erased more than $6.5 billion in medical debt for 2.5 million residents. Governor Josh Stein emphasized that medical debt is a barrier to financial security and well-being (ABC45, 2025).

- In August 2023, Colorado enacted a consumer protection law that excluded all medical debt information from credit reports, dropping the share of people with debt in collections to zero.

Key Takeaways

Multi-layer maps are a powerful tool to visualize disparities and trends in medical debt. The ability to map intersectional disparities can illuminate the most vulnerable communities and support and guide policy discussions and advocacy. The data is also licensable for integration into reports or public-facing tools for further insights.

Millions of Americans could face even higher health insurance costs as the government shutdown continues and the future of Affordable Care Act subsidies is still undecided. The new federal guidance on medical debt policies is not legally binding, and its ultimate outcome will be determined in court, leaving the future of medical debt reporting uncertain.

Request More Information

Want to see how PolicyMap can help your organization visualize and address the local impacts of medical debt? Connect with our team to learn more about how our data and mapping tools strengthen your policy analysis and advocacy around medical debt and access to care.