Where Elderly Americans Struggle to Find Affordable Housing

Digging Deeper into Rising Homelessness among Seniors

Cities around the country are devising new strategies to create more affordable housing opportunities. Current data shows us why.

A recent article in the Wall Street Journal chronicled the lives of baby boomers living in Florida on Social Security and unable to secure affordable rental housing. They are rotating between “couch-surfing” at friends’ homes, living in their cars, or sleeping on the street. While the article cited several areas across the country where the percentage of homeless people over the age of 65 is growing rapidly, Miami-Dade County rose to the top. As of the end of 2022, it was reported that over 31% of people over the age of 65 were homeless.

Rent Payments vs. Social Security Payments

The most recent data from the Census’ American Community Survey (ACS) estimates that 435,000 people over the age of 65 live in Miami-Dade County. Of them, a full 40.4% or 176,000 people have incomes less than $25,000 per year. As of February 2023, the average SSI check was $1,693 per month or $20,300 per year. It would not be a stretch to assume that most of these 176,000 people with annual incomes less than $25,000 are living off their Social Security benefits alone.

So, what rent can you afford when your monthly income is $1,693? According to HUD, a household is considered burdened when they spend more than 30% of their income on housing and severely burdened when they spend more than 50% of their income on housing. Ideally, an individual in this case would want to spend no more than $510 per month on housing for it to be considered affordable.

Can You Survive on $1,693 a Month in Miami-Dade?

In Miami-Dade finding a place at that rent level is highly unlikely. Again, looking at the latest data from ACS, there are 22,145 studio or 1-bedroom apartments with rents below $500 per month in Miami-Dade. This number includes the many low-income housing units available in the county through programs such as HUD Multifamily Developments, Public Housing, Low-Income Housing Tax Credit Developments, Housing Choice Vouchers, and some USDA Multifamily Developments. The supply of 22,145 units clearly dwarfs the 176,000 older people in need.

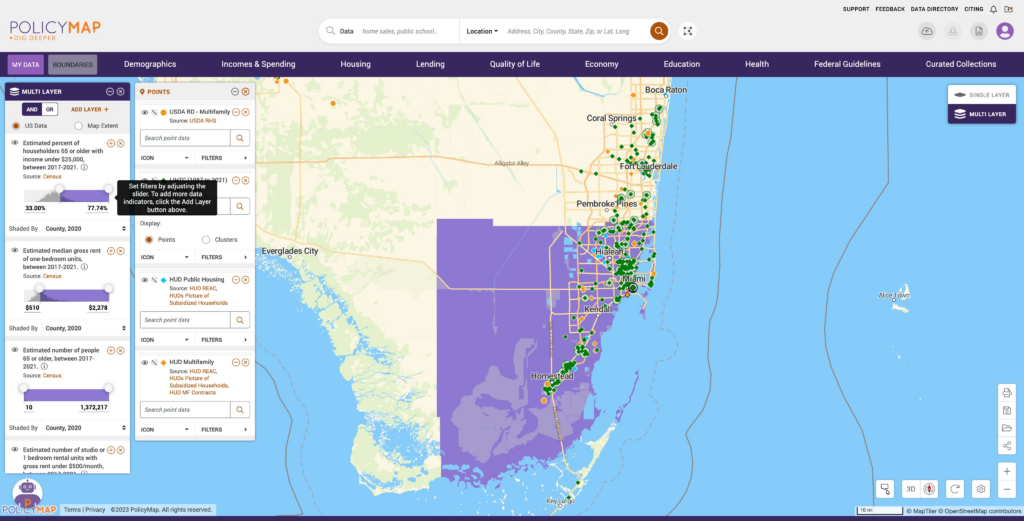

The map below shows Miami-Dade County in purple and notes these statics. The locations of subsidized housing are shown as points on the map and are primarily clustered in Miami, Kendall and Fort Lauderdale.

How Some American Cities Combat the Housing Affordability Crisis

The affordability problem is not limited to Miami Dade County nor is it limited to people over 65, as has been analyzed by Census and research firms such as Moody’s Analytics. As home prices surge and rents increase, growing parts of the country have become unaffordable for renters. Some argue that the 30% affordability rule is now outdated but the fact remains that paying more than that toward your housing costs leaves you with little left for food and other necessities, particularly when living off social security alone.

Affordable housing strategies are being introduced to deal with the escalating crisis. New York City is trying to increase the number of affordable housing units through rezoning and reduction of red-tape, Miami introduced an $11.7 billion budget to increase affordable housing (the largest in the county’s history) and on July 1, a new ordinance in Denver requires that all new residential developments of 10 or more units designate 8% to 12% of the units as affordable.

Request More Information

Data in PolicyMap can help you understand the strains facing renters and other populations in your community. Contact us to learn more.