Addressing Racial Inequality by Investigating Mortgage Denials

Data

Mortgage Loan Denials

Source

Find on PolicyMap

- Lending

- Mortgage Loan Denials

- All Mortgage Denials

- Home Purchase Loans

- By Race or Ethnicity

Home ownership has traditionally been one of the main vehicles for accumulating and inheriting wealth in the United States. But not everyone has an equal chance to purchase a home. Since few people have the cash to buy a home outright, their ability to purchase a home is controlled by whether a bank will provide them a mortgage.

Knowing where home mortgages are being denied at high rates can give important insight into where families are unable to access this crucial tool in generating wealth. PolicyMap’s new home mortgage denial data, which covers applications between 2012 and 2018 and is available with a PolicyMap subscription, can reveal which neighborhoods are facing the greatest challenges for securing home loans.

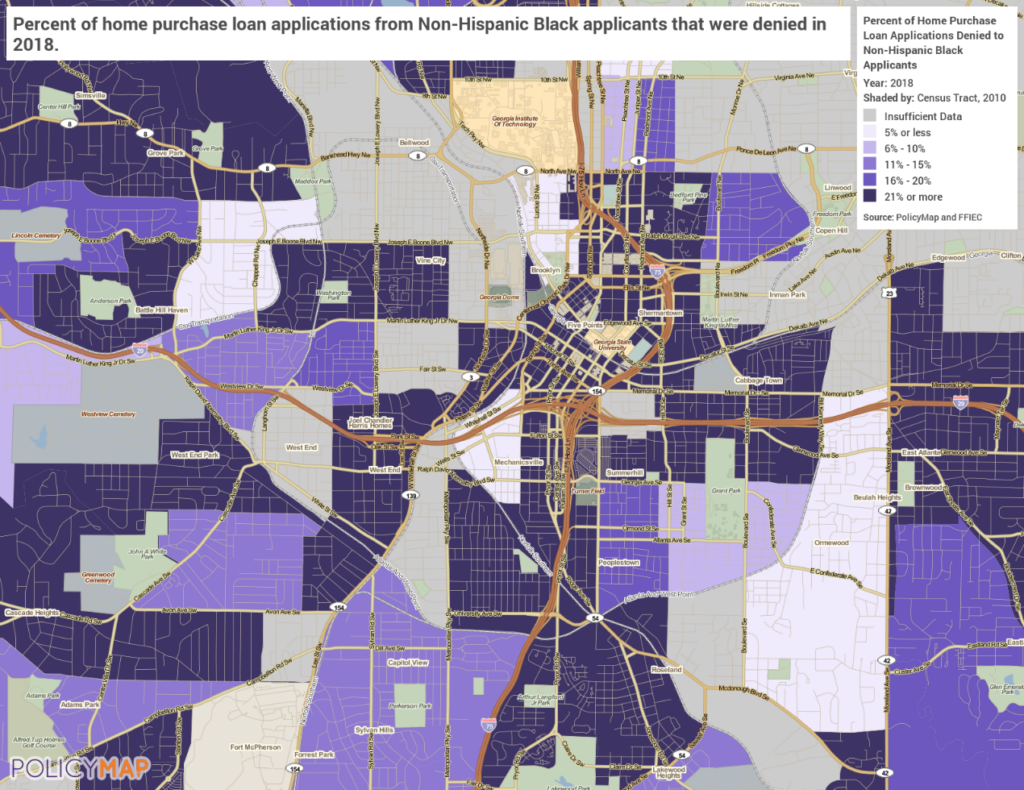

Historically, the real estate industry kept Black families and other racial and ethnic minorities from securing home mortgages through “redlining,” or deeming certain neighborhoods as “hazardous” and denying mortgages there as a matter of policy, regardless of the applicant’s means. In Atlanta, for example, neighborhoods that were deemed “hazardous” or “definitely declining” were majority Black, whereas those tagged “still desirable” or “best” were majority White. We can see these historic designations from the 1930s using risk maps from the Home Owners’ Loan Corporation.

This practice was legally stopped with the Fair Housing Act. But though the act makes racial discrimination in housing lending decisions illegal, Black families are still more likely to be denied for their mortgage applications than White families.

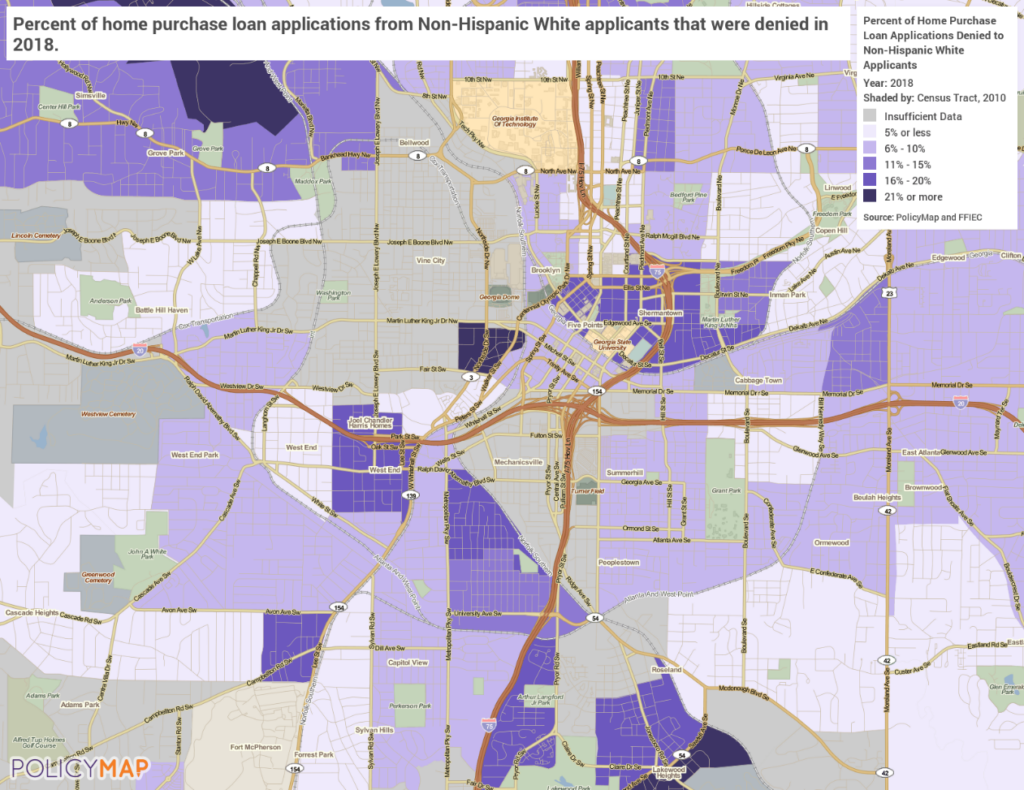

In Atlanta, Black people applying for mortgages to purchase homes are denied at higher rates than White people throughout the city.

A number of factors contribute to the persistent racial inequity in mortgage denial rates. The first is historic. Because of redlining, unequal access to education and jobs, and other systemically racist practices, Black families and other families of color have had a harder time developing generational wealth, either through homeownership or other investments.

This contrasts with people belonging to wealthier families, who are more likely to be able to pull together a larger down payment, which makes getting a mortgage easier. Wealthier families may have an easier time purchasing a home that helps them build more wealth that they can pass to their children, and the cycle continues.

A related issue is that people of color are more likely to have lower credit scores, which also influence mortgage acceptance rates. Research has shown, however, that mortgages applicants who are not white still have higher denial rates than those who are, even when controlling for credit score.

Cities with these kinds of persistent race-based unequal access to housing can use neighborhood data to find areas where partnerships with local organizations can help spread the word about programs that help residents buy homes. They can also identify areas that can benefit from consumer protection regulations to limit credit-damaging predatory loan companies that may operate in those neighborhoods.

The mortgage loan denial data was created by PolicyMap using data from the Federal Financial Institutions Council (FFIEC), collected as part of the Home Mortgage Disclosure Act (HMDA). The data is available to all PolicyMap subscribers, and is in the Lending menu.

For more analysis of mortgage data from FFIEC:

https://www.zillow.com/research/black-white-mortgage-denials-19616/